|

50 items gevonden voor 'Trends' in vrijdag

De links 1 t/m 50.

Nieuwsbronnen (1)

| World: SmallBusinessTrends: |

| |

Belgie: Knack.be_Gezondheid: [ Geolocation ] (Laatste update: vrijdag 22 april 2022 08:31:36)

|

Huisartsentekort zet eerstelijnszorg onder druk

Door de druk van covid-19 op de eerstelijnszorg dacht één op de drie huisartsen aan stoppen. Nu de pandemie op haar retour is, zijn de onderliggende problemen niet verdwenen. De eerste lijn is dan wel de sterkhouder van de zorg, maar ze kraakt aan alle kanten.

Wed, 06 Apr 2022 21:00:04 +0200

|

| |

Europa: Belgie: Knack.be [ Geolocation ] (Laatste update: vrijdag 22 april 2022 23:27:25)

|

Thierry Saegeman (Engie) en Gerrit Jan Schaeffer (EnergyVille): 'Prijspieken horen bij de energietransitie'

De grote elektriciteitscentrales maken plaats voor een slim netwerk van groene stroom, maar de energietransitie wordt hobbelig en bijwijlen duur. "Maar we mogen optimistisch zijn. Aan het einde van de rit krijgen we een stabiel, betaalbaar en duurzaam energiesysteem", zeggen Thierry Saegeman en Gerrit Jan Schaeffer, die namens Engie en EnergyVille een nieuw samenwerkingsakkoord sloten.

Wed, 20 Apr 2022 21:00:04 +0200

|

| |

Europa: Duitsland: Der Spiegel [ Geolocation ] (Laatste update: vrijdag 13 oktober 2023 18:59:22)

|

IQB-Bildungstrend: Gewöhnt euch nicht an die schlechten Ergebnisse! - Kommentar

Die Ergebnisse des IQB-Bildungstrends sind erneut desaströs. Der eigentliche Skandal daran: Das überrascht kaum noch. Es droht ein riskanter Gewöhnungseffekt.

Fri, 13 Oct 2023 16:27:17 +0200

|

| |

Nederland: Toprankblog.com: [ Geolocation ] (Laatste update: vrijdag 13 oktober 2023 16:33:28)

|

Elevate B2B Marketing News Weekly Roundup: Experiences Drive Brand Success, New Dall-E 3, & X’s Paid Future

B2B Content Promotion in 2023: Channel and Format Trends [Report] 97.7 percent of B2B content marketers used LinkedIn to amplify...

The post Elevate B2B Marketing News Weekly Roundup: Experiences Drive Brand Success, New Dall-E 3, & X’s Paid Future appeared first on B2B Marketing Blog - TopRank®.

Fri, 22 Sep 2023 10:30:45 +0000

|

| |

Nederland: Vrij Nederland: [ Geolocation ] (Laatste update: vrijdag 29 september 2023 19:42:19)

|

Wat er moet gebeuren wil een nieuw kabinet de begroting weer op orde krijgen

De macro-economische situatie bepaalt in hoge mate hoe krap of hoe ruim het begrotingsbeleid zou moeten zijn. Jarenlang stond de rente op de ondergrens van de centrale bank, nabij nul. De inflatie was niet omhoog te branden. En de economie groeide maar matig. Economen spraken van langdurige stagnatie. Bij chronisch tekortschietende vraag en lage inflatie was het verstandig om een ruim begrotingsbeleid te voeren. Bovendien was geld lenen voor de overheid gratis.

Maar toen kwamen corona en de oorlog in Oekraïne. De economie werd geraakt door zowel negatieve aanbod- als positieve vraagschokken. Het aanbod in de economie nam tijdens corona af door de ontregeling van de productieketens vanwege de lockdowns, de verstoringen in de internationale handel (denk aan Brexit en de spanningen tussen de VS en China) en de sterk gestegen prijzen van grondstoffen, transport, energie en voedsel na de Russische invasie van Oekraïne.

Tegelijkertijd werd de vraag aangejaagd door de compensatiepakketten voor de covid- en energiecrisis, een ruim begrotingsbeleid en een (aanvankelijk) ruim monetair beleid. Toen de coronabeperkingen werden opgeheven, vlogen de opgepotte besparingen als een klodder ketchup door de economie. Het gevolg was enorme inflatie en een terugval van de economische groei.

Macro-economisch debat

Tegen deze achtergrond woedde een groot macro-economisch debat, met als hoofdrolspelers Larry Summers en Paul Krugman. Hamvraag: waren deze schokken tijdelijk of permanent? Het antwoord was, zo blijkt nu: beide. Veel van de covid- en Oekraïneschokken zijn inmiddels weggeëbd. Zo zijn de productieketens hersteld en de energieprijzen weer genormaliseerd. Tegelijkertijd zijn er permanente gevolgen in de vorm van sterke prijs- en loonstijgingen die nu de belangrijkste oorzaak zijn van de hardnekkig hoge inflatie van bijna 4 procent dit en volgend jaar.

De consensus onder economen is dat we nog steeds aanzienlijke overbesteding hebben. Dat zien we niet alleen terug in de hoge inflatie, maar ook op de arbeidsmarkt. Daar is personeel nog altijd moeilijk te krijgen. De CPB-schatting van de output gap geeft ook aan dat we veel meer proberen te kopen dan dat we kunnen produceren.

De overheid moet zuinig blijven zolang inflatie nog niet terug is op het doel van de ECB.

Het begrotingstekort verslechtert volgens de laatste CPB-ramingen in hoog tempo, tot zo’n 4 procent van het bruto binnenlands product (bbp) in 2028. De overheid blijft de economie dus stimuleren, en het begrotingsbeleid is daarom veel te ruim. Alle scholen in het economisch denken, van neoklassieken tot keynesianen, geven nu hetzelfde advies: de begroting moet worden verkrapt om de vraag en daarmee de inflatie niet verder aan te jagen. De overheid moet zuinig blijven zolang inflatie nog niet terug is op het doel van de Europese Centrale Bank (ECB).

De komende kabinetsperiode moeten de overheidsuitgaven daarom omlaag of de belastingen omhoog. Maar met hoeveel? Dat is een lastige vraag. De economie koelt in hoog tempo af. Centrale banken hebben wereldwijd ongekende renteverhogingen doorgevoerd om de inflatie te beteugelen. Mede daardoor zit Nederland op dit moment in een technische recessie.

Tegelijkertijd laten de ramingen van het CPB zien dat de groei zich in de loop van 2023 herstelt, zodat we over heel 2023 nog 0,7 procent en volgend jaar met 1,4 procent groeien. Maar nog steeds is onduidelijk of de ECB deze zachte landing van de economie weet te maken – misschien moet die de rentes nog meer verhogen om de inflatie de kop in te drukken, en dat kan de economie alsnog in een recessie duwen.

Negatieve aanbodschokken

Complicerende factor is dat nieuw kabinetsbeleid pas over een jaar of twee doorwerkt in de economie. Het tekort te snel en te hard reduceren, kan averechts uitpakken. Maar te weinig doen kan de inflatie en krapte verder aanwakkeren en de overheidsfinanciën op lange termijn uit het lood doen slaan.

Op lange termijn moet de overheid voorkomen dat de overheidsfinanciën onhoudbaar worden en de staatsschuld explosief toeneemt. Of dat gebeurt, wordt bepaald door drie dingen: de rente op de staatsschuld, de groeivoet van de economie en het structurele overheidstekort. Hoe hoger de rente, hoe lager de groei, en hoe groter het tekort, hoe sneller de begroting ontspoort.

Economen weten niet precies wat er op middellange termijn met de rente gaat gebeuren. Voormalig chef-econoom van het IMF, Olivier Blanchard, denkt dat de rente weer omlaag gaat als centrale banken de inflatie hebben bedwongen. Die rente is langdurig laag geweest door structurele trends die niet ineens door corona en Oekraïne omkeren. Door de vergrijzing en groeiende inkomensongelijkheid wordt er meer gespaard. Daarnaast lijkt de technologische ontwikkeling te vertragen en is minder spaargeld nodig om nieuwe investeringen te financieren. Bedrijven investeren meer in goedkope IT dan in duur vastgoed en dure machines. Daarnaast vragen banken, pensioenfondsen en verzekeraars structureel meer veilige staatsobligaties.

Maar recente ontwikkelingen duiden wel op een stijging van de overheidsrentes, zoals de huidige chef-econoom van het IMF, Gita Gopinath betoogt. Door alle crises zijn de overheidstekorten en -schulden structureel hoger. Daarnaast neemt de investeringsvraag toe door de klimaattransitie. Bovendien zijn er ook structurele, negatieve aanbodschokken, zoals minder wereldhandel en de afvlakking van het arbeidsaanbod. Een terugkeer naar langdurige stagnatie is volgens haar niet uitgesloten, maar minder waarschijnlijk. De rente voor de overheid zal daarom wel wat dalen maar niet meer zo laag worden als die voor corona was.

Een forse tekortreductie

Welk tekort kan de overheid zich dan structureel veroorloven zodat de staatsschuld op lange termijn houdbaar is? Op de financiële markten bedraagt de 10-jaarsrente op staatsleningen 3 procent nominaal en 1 procent reëel (voor inflatie gecorrigeerd). De structurele groeivoet van de economie is ongeveer 1 procent per jaar. De overheid zou bij deze rente en groei dan in 2028 een begrotingstekort moeten hebben van ergens tussen de 1 en 2 procent van het bbp om de staatsschuld op lange termijn tussen 60 en 90 procent van het bbp te stabiliseren. Daarbij wordt rekening gehouden met de CPB-schatting voor overbesteding van zo’n 1,5 procent van het bbp gemiddeld gedurende 2024-28.

De volgende regering moet daarom een forse tekortreductie doorvoeren van 2 tot 3 procent van het bbp. Dat is een ombuiging van circa 20 tot 30 miljard euro op de begroting. Dat vereist na jaren van laks begrotingsbeleid het aanhalen van de teugels.

Nederland heeft bovendien nog altijd grote maatschappelijke opdrachten bij klimaat en stikstof. De belabberde productiviteitsgroei vraagt bovendien om grotere overheidsinvesteringen in onderwijs, onderzoek en infrastructuur.

Het zou daarom verstandig zijn om in de begroting een structurele investeringsruimte te maken van ongeveer 1 procent bbp, circa 10 miljard per jaar. Maar alleen voor beleidsmaatregelen die aantoonbaar rendabel zijn, bijvoorbeeld met een kosten-batenanalyse van het CPB. Dat betekent dat het begrotingstekort kan oplopen tot 2 à 3 procent van het bbp aan het einde van de volgende kabinetsperiode als de investeringsruimte volledig zou worden benut. De staatsschuld komt dan op lange termijn uit op ongeveer 90 tot 120 procent van het bbp.

De investeringsruimte zou ook in de plaats moeten komen van alle investeringsfondsen voor klimaat en stikstof en het groeifonds. Deze fondsen hebben de begroting ontwricht, veroorzaken bestuurlijke onrust en leiden tot bestedingsdrift waardoor publiek geld wordt verspild.

Een deel van de begrotingsopgave kan ook worden gedekt door verspilling te voorkomen. Zo kan worden besloten om ondoordachte plannen voor gratis kinderopvang niet door te laten gaan. De overheid zou daarnaast een maximumprijs moeten instellen per ton bespaarde CO2 en stikstof: kost een maatregel te veel geld, dan wordt die niet ingevoerd. Ook zou de overheid bij klimaat- en stikstofbeleid veel meer moeten beprijzen en normeren in plaats van subsidies uit te delen. Daarnaast kan de overheid geld vrijspelen door de groei van de zorguitgaven af te remmen en belastingen op vermogensinkomsten te hervormen.

Er is met geld gesmeten om politieke tegenstellingen af te kopen.

Tot slot zou de rust in het begrotingsbeleid moeten terugkeren. De afgelopen jaren waren de meest chaotische van de afgelopen decennia. Daar waren goede redenen voor: door corona en de invasie van Oekraïne waren snelle en omvangrijke overheidsinterventies nodig. Maar ontegenzeggelijk zijn de begrotingsprocessen de afgelopen jaren ook sterk ondermijnd door groeiende politieke fragmentatie en polarisatie; er is met geld gesmeten om politieke tegenstellingen af te kopen.

Zonder grote externe turbulentie moet het aantal besluitvormingsmomenten weer tot één moment per jaar worden teruggebracht. De begrotingsregels moeten worden herzien op een manier die recht doet aan de politieke realiteit én niet leidt tot ontwrichting van de overheidsfinanciën op lange termijn. Het zou daarom goed zijn als een nieuwe regering aansluit bij EU-plannen voor de herziening van de begrotingsregels. Een nieuwe regering zou bovendien heldere spelregels moeten formuleren over wat te doen met de miljarden die op de plank blijven liggen door aanhoudende krapte en personeelsgebrek. Het CPB schat die ‘onderuitputting’ voor 2024 op maar liefst 15 miljard euro.

De moeilijke opdracht voor een nieuwe regering is daarom de begrotingsorde en -rust te herstellen, verstandig macro-economisch beleid te voeren, de overheidsfinanciën op lange termijn houdbaar te houden en ruimte te maken voor noodzakelijke publieke investeringen. We zullen de komende maanden gaan zien welke partijen deze opdracht serieus nemen.

Het bericht Wat er moet gebeuren wil een nieuw kabinet de begroting weer op orde krijgen verscheen eerst op Vrij Nederland.

Wed, 20 Sep 2023 02:51:40 +0000

|

| |

World: Big Think.com: [ Geolocation ] (Laatste update: vrijdag 13 oktober 2023 14:15:38)

|

Mindfulness: New age craze or science-backed solution?

Mindfulness has become a billion-dollar industry.Research shows mindfulness can be an effective wellness practice, yet the effect sizes found in studies tend to be moderate.Mindfulness may be worthwhile, but only if we approach it with understanding and realistic expectations.

Unless you've recently returned from a hermitage atop the sacred mountain, you've probably noticed that mindfulness has become a big deal. As measured by Google searches, interest in the East Asian tradition has risen significantly in the last two decades, and more Americans are practicing either yoga or meditation. CEOs and celebrities plug it as key to their health, success, and happiness, while companies have adopted it to bolster innovation and productivity.

With that groundswell of attention has come a deluge of influencers, self-help gurus, and wellness experts� all hawking their wares and claims in hopes of slicing off a portion of a soon-to-be $9 billion industry. Some of the more breathless promises allege mindfulness can unlock your full potential, make your memory foolproof, make you better than ordinary, and even bend reality to your desires. And if that seems like too much work, you can fast track your way to higher consciousness with some chakra tea or a slathering of mindful mayo on your banh mi sandwich.

It all has an air of chic diets and insane exercise routines, and the noise of the marketplace makes it difficult to separate the fad from the function� a necessary step for anyone hoping to incorporate mindfulness into their lives safely and sustainably. Journey to the West

As a spiritual practice, mindfulness had made the journey westward through teachers such as Ram Dass and Thich Nhat Hanh, but its first dalliance with science came through Jon Kabat-Zinn. As an MIT student, Kabat-Zinn took an interest in meditation and incorporated it into his biology studies. After graduating, he founded the Center for Mindfulness and began researching a secular form of the practice called mindfulness-based stress reduction (MBSR), which Kabat-Zinn developed himself.

"When I started [...], there was virtually no science of mindfulness whatsoever," Kabat-Zinn said during a Big Think+ interview. "Part of my original aim was to use the clinic as a kind of pilot to see whether we could catch people falling through the cracks of the healthcare system and challenge them to do something for themselves that no one else on the planet could possibly do for them, including their physicians: to move in a direction of greater well-being and healing."

Kabat-Zinn's studies signed up participants for an intensive eight-week MBSR program. The workshop included formal instruction in mindfulness techniques, group meetings, and homework between sessions. It aimed to help participants develop a non-judgmental awareness of the present moment, while Kabat-Zinn analyzed how that affected their mental and physical wellness. And this pilot program showed promise.

Kabat-Zinn's research (and later studies) found that mindfulness practitioners enjoyed less stress, anxiety, and depression. Further studies have since identified mindfulness as a potential tool for reducing chronic pain, lowering blood pressure, aiding insomnia, and lessening the body's inflammatory response to stressors. Preliminary research has even suggested that mindfulness can make us less racially biased and lengthen our telomeres, a chromosomal region that stands as a biomarker of human aging.

"I don't want to overstate the evidence because the entire field is in its infancy, but the vast majority of studies are suggesting that when you do something as simple as what looks from the outside like nothing, this is having profound effects," Kabat-Zinn added. Mind the research gap

But given promises of extraordinary bliss and god minds, others obviously lack Kabat-Zinn's restraint for overstatement and over-selling. And here's where the science bumps against the commercialized woo. While mindfulness effects are present in the data, they aren't incredibly robust. A systematic review and meta-analysis published in JAMA Internal Medicine looked at 47 randomized clinical trials with active controls (totaling 3,515 participants). It found moderate evidence of mindfulness easing anxiety, depression, and pain; low evidence for assuaged stress; insufficient evidence of reduced substance abuse and poor eating habits; and no evidence that mindfulness was better than other treatment options. Similar results can be found across the scientific literature. Another meta-analysis found slightly larger but still moderate effect sizes. Still another� this one looking at mindfulness-based therapy� found a moderate effect size but not one larger than other therapies or pharmacological treatments. As for individual studies, these can be limited in their predictive value. That study showing mindfulness reduced racial bias, for example, had only 72 participants� all of them midwest college students. Mindfulness research also faces methodological concerns� such as an over-reliance on self-reporting questionnaires� and even struggles with basic terms� there is no universally accepted definition of mindfulness and few studies today follow Kabat-Zinn's strict MBSR program. All of this has led researchers to take a hopeful yet cautionary stance on mindfulness and its benefits. Unfortunately, these scientific findings have grown with each telling on social media, talk shows, and self-help books. In the wilds of our capitalist culture� freed from the pruning effects of science's checks and balances� the practice is no longer a proper stress management tool but the "ultimate stress-reliever." It's no longer a complement to traditional therapies but a more potent analgesic than painkillers. And, in the words of Arianna Huffington, founder of the Huffington Post, it has become a literal "matter of life and death." None of which is true. Yet, such proclamations still lead those who follow the fashion to happily part with hundreds of dollars on chimes, Lululemon yoga pants, and meditation app subscriptions. "It's important we understand the risks and don't overstate the potential benefits until they're robustly substantiated," writes Jason Linder, PsyD, at Psychology Today. "Practicing mindfulness when you're not mentally ready, or when you actually need a nap, to eat, a massage, to work, or an important conversation with a loved one can clearly create more difficulties than it's meant to mitigate." A 10-percent solution?

As Linder says, mindfulness is just one method available to us and not the right one for every occasion. But pop-culture prescriptions written as a cure-all can have dire consequences. Emboldened by stories of "I did it and so can you," some may forgo traditional therapies and medicines in favor of mindfulness� a kind of mental self-medication.

This can be harmful. In some people, mindfulness practices have been shown to amplify certain psychiatric problems associated with worry and depression. Those who go it alone, without the supervision of a qualified psychiatrist or teacher, may blame themselves for their failures. After all, everyone seems to be mastering it� just look at all those peaceful, smiling faces on the YouTube videos. It's a false perception, yes. But if someone is already struggling with depression, that perception can compound their emotional slump.

Of course, this isn't to say that mindfulness doesn't work. Small-to-moderate effect sizes aren't zero, and for many, mindfulness has proven a source of great ease and comfort. But if you go into mindfulness thinking you'll become a mental Superman� that life's difficulties will bounce harmlessly off your chest like bullets every which way� you're in for a disappointment.

Life will continue to be life no matter how often you focus on the breath, and that includes all the stresses and challenges that were present before. What mindfulness can help you do is reduce the stress you carry and become more resilient to stressful events. That can add up to being happier overall.

How resilient? How much happier? As should be obvious by now, there is no magic number, but the experiences of journalist and mindfulness evangelist Dan Harris can give us an idea.

While reading the news on-air, Harris suffered a panic attack in front of 5 million people. As he told Big Think in an interview, the attack stemmed from his work-related depression and attempt to self-medicate with recreational drugs. Part of his treatment process was to take up meditation. It didn't solve his substance abuse problem, nor did it purge the depression from his soul. It did, however, grant him a 10-percent bump in happiness, stress reduction, and joie de vivre.

"If you can get past the cultural baggage, though, what you'll find is that meditation is simply exercise for your brain. It's a proven technique for preventing the voice in your head from leading you around by the nose," Harris writes in 10% Happier. "In my experience, meditation makes you 10% happier. That's an absurdly unscientific estimate, of course. But still, not a bad return on investment."

Not bad at all.

Go deeper with Big Think+Our Big Think+ class "Paying Attention on Purpose" with Jon Kabat-Zinn will unlock key lessons for your mindfulness practice, both at work and in your everyday life. - The Art of Mindfulness

- The Neuroscience of Mindfulness

- Four Ways to Practice Mindfulness

- Wake Up to the World

- Elevate Your Health

- Liberate Yourself from Your Thoughts

- Liberate Yourself from the 3 Toxic Impulses

- Reconcile Mindfulness and Ambition

- Bring Mindfulness to the Workplace

Learn more about Big Think+ or request a demo for your organization today.

Wed, 15 Sep 2021 13:40:03 +0000

|

| |

World: Frankwatching.com: [ Geolocation ] (Laatste update: vrijdag 6 oktober 2023 21:41:30)

|

Enshittification: de onvermijdelijke ondergang van online platformen

Google Search, Facebook, X (Twitter), Instagram en Etsy… Ze hebben allemaal last van ‘enshittification’ (ook bekend als platform decay). In 2023 is deze term steeds bekender geworden. En als je het eenmaal herkent, zie je het overal gebeuren. Maar het zet je ook aan het denken: waarom is het zo moeilijk om een verslechterend platform […]

Fri, 06 Oct 2023 11:00:00 +0000

|

Nieuwe website? Zet je strategie op één A4

Je wil graag grip op het resultaat van je nieuwe website. Natuurlijk heb je wel een idee van het aantal bezoekers en belangrijke conversies. Maar hoe hou je grip op de lange termijn? Waar ga je op meten en hoe kader je dat zonder nietszeggende rapporten of complexe dashboards? In dit drieluik over het proces […]

Fri, 06 Oct 2023 06:00:00 +0000

|

Canva lanceert Magic Studio: ontdek alle nieuwe AI-tools

Het is zover: Canva komt met Magic Studio. De plek voor alle AI-mogelijkheden in de designtool. Ik nam een kijkje en deel met je wat je er allemaal mee kunt. Het is duidelijk, Canva gaat volledig voor AI. Vanochtend waande ik me in een magische wereld. Foto’s konden veranderen in presentaties, ongewenste video-achtergronden konden verdwijnen, […]

Thu, 05 Oct 2023 14:00:00 +0000

|

Google Search Generative Experience (SGE): de nieuwe manier van zoeken

Het nadeel van generatieve AI-tools is dat het geen échte zoekmachines zijn. Ook al lijkt het misschien zo door de antwoorden die ze vlot genereren. ChatGPT is inmiddels geïntegreerd in Bing Chat. Dan kan marktleider Google toch zeker niet achterblijven? Met de Search Generative Experience (SGE) gaat Google de huidige manier van zoeken combineren met […]

Thu, 05 Oct 2023 12:00:00 +0000

|

4 Black Friday-tips: maak van de koopjesjager een trouwe klant

Black Friday: de jaarlijks terugkerende “feest”dag waarop veel winkels, zowel offline als online, stunten met enorm hoge kortingen en interessante deals. Deze Amerikaanse traditie is inmiddels ook in Nederland uitgegroeid tot een waar fenomeen dat – anders dan de naam doet vermoeden – vaak dagen en soms wel weken duurt. Veel webshops verwelkomen tijdens de […]

Thu, 05 Oct 2023 09:00:00 +0000

|

Zo scoor je als gemeente op LinkedIn, Instagram en Facebook [onderzoek]

Hoe maken gemeenten de juiste keuzes en sluiten ze met hun sociale media aan bij de behoeften van inwoners? Als dat namelijk gebeurt, volgen ook meer inwoners hun socialmedia-pagina’s en wordt het bereik vergroot. Dit helpt bij de verspreiding van informatie aan de inwoners. Het maakt het daarnaast ook makkelijker om met een diversiteit aan […]

Thu, 05 Oct 2023 06:00:00 +0000

|

9 LinkedIn-typetjes: herken jij jezelf?

Als portretfotograaf heb ik extra aandacht voor portretten die ik voorbij zie komen op LinkedIn. De meeste profielen op LinkedIn zijn helemaal in orde maar soms zie ik erg vermakelijke en vreemde portretfoto’s en profielen voorbijkomen. De onderstaande 9 profielen zijn niet al te echt (op 1 na), maar zullen vast wel de nodige herkenning […]

Wed, 04 Oct 2023 11:00:00 +0000

|

27 ingrediënten voor een effectieve prompt

Ik vermoed dat het nog steeds de meestgestelde vraag over ChatGPT is: hoe schrijf ik een goede prompt? Ik heb 27 tips voor je op een rij gezet die je helpen om effectieve prompts te schrijven, zodat je output krijgt waar je wat mee kan. Prompts als mini-briefings aan ChatGPT ‘Maak deze tekst minder clichématig’ […]

Wed, 04 Oct 2023 06:00:00 +0000

|

De invloed van macht bij leiderschap

Wie het nieuws volgt, weet dat geen enkele sector lijkt te ontkomen aan machtsmisbruik en grensoverschrijdend gedrag. Gooi alle berichten op een hoop en het ligt voor de hand om te denken dat je macht kunt gebruiken en misbruiken. De derde smaak, macht zo min mogelijk gebruiken, blijft wat onderbelicht. Wie leiding geeft – en […]

Tue, 03 Oct 2023 12:00:00 +0000

|

Rechtenvrije AI-stockfoto’s? Getty Images & 3 andere tools onder de loep

Komen stockfoto’s ook jouw neus uit? Je ziet ze overal (ja, ook hier bij Frankwatching): de meest suffe, overgestylede, in scene-gezette afbeeldingen die we kunnen downloaden van sites als Pexels, Unsplash en Pixabay. De komst van AI-tools biedt hierin een mooie uitkomst: unieke plaatjes! Maar waar vind je deze AI-stockfoto’s, en mag je ze zomaar […]

Tue, 03 Oct 2023 09:00:00 +0000

|

Reels filteren, long form-video’s & 6 andere Instagram-updates

Ben jij op Instagram al uitgenodigd voor een uitzendingskanaal? En wist je dat je vanaf nu in Reels kunt filteren op video’s van mensen die je volgt? Het regende de afgelopen tijd weer Instagram-updates. In dit artikel bespreek ik 8 interessante en uiteenlopende nieuwe features die je niet mag missen. 1. Uitzendingskanalen Afgelopen zomer rolde […]

Tue, 03 Oct 2023 06:00:00 +0000

|

Zo bundelen marketing & HR wél hun krachten [3 stappen]

Het vinden van nieuwe medewerkers is één van de grootste uitdagingen van deze tijd. We vissen allemaal in dezelfde vijver en talent is schaars. Over het belang van een goede samenwerking tussen HR en marketing bij het vinden van talent zijn al heel wat artikelen geschreven. Maar toch horen we marketeers vaak mopperen dat het […]

Mon, 02 Oct 2023 12:00:00 +0000

|

10x populair: LinkedIn-clichés, arbeidsmarkttrends & ChatGPT als schrijfpartner

De belangrijkste trends voor de arbeidsmarkt en recruitment, opvallende updates voor ChatGPT en hoe je een marketingproject tot een succes maakt zonder groot budget… Ik mocht dit keer de top 10 best gelezen Frankwatching-artikelen van de maand september schrijven. Deze intro zou ik zo op LinkedIn kunnen posten, maar dat ‘mogen’ wordt toch wel als een […]

Mon, 02 Oct 2023 09:00:00 +0000

|

De 6 grootste socialmedia-trends voor 2024

Short form video’s, social commerce en de rol van content creators… Het zijn drie van de zes socialmedia-trends die aan bod komen in 2024. Maar ook de belangrijke rol voor AI, waar we voor komend jaar zeker niet omheen kunnen. Waar kunnen we ons als marketing- en communicatieprofessionals op voorbereiden komend jaar? Bijna een jaar […]

Mon, 02 Oct 2023 06:00:00 +0000

|

Van digitizing naar digitalization: leer van RaboBank, PostNL, bol.com & Efteling

Chatbots, messaging, voice, AI… houd jij de ontwikkelingen in het conversational landschap nog bij? In dit artikel lees je hoe Rabobank, PostNL, bol.com & Efteling hiermee omgaan om hun customer service én -experience naar een hoger niveau te tillen. Laat je inspireren! Spoiler alert: op het gebied van customer service, customer experience en generatieve AI […]

Sun, 01 Oct 2023 07:00:00 +0000

|

LinkedIn InMail als effectief communicatiemiddel met deze 5 tips [infographic]

Wellicht ben je een dagelijkse gebruiker of kijk je er nauwelijks in. De ‘mailbox’ van het zakelijke platform LinkedIn is een handig communicatiemiddel om persoonlijke berichten te versturen en een-op-een-contact te onderhouden met leden uit jouw netwerk. Met LinkedIn InMail gaat dat nog een stapje verder. We delen 5 tips. Wat is InMail? Voordat we […]

Sat, 30 Sep 2023 07:00:00 +0000

|

ChatGPT-updates: voice, afbeeldingen & toegang tot het hele internet

OpenAI kondigde afgelopen week aan dat voice beschikbaar is in ChatGPT en dat je binnenkort afbeeldingen kan uploaden en zelfs kan laten genereren met een prompt. Daarnaast heeft ChatGPT straks toegang tot het hele internet en is de output dus actueel. Ik krijg serieuze AI-FOMO van al deze ontwikkelingen, dus ben er in gedoken en […]

Fri, 29 Sep 2023 11:00:00 +0000

|

Open deuren intrappen op de socials? Wees eens wat origineler

Column – Hoe verras je je lezer op social media? Hoe zorg je dat je bericht blijft hangen? Het kan wel eens helpen om wat origineler te zijn. Om echt zelf een originele gedachte te vormen en dáár over te schrijven. Op 1 maart is het Complimentendag. En dat is het altijd op 1 maart en […]

Fri, 29 Sep 2023 06:00:00 +0000

|

Van Black Friday naar Black FridAI: de AI-mogelijkheden

Langzaam maar zeker worden de winkels gevuld met producten voor de koopjesjagers die op zoek zijn naar de beste deals van het jaar. Black Friday. Deze jaarlijkse winkelgekte is de start van het feestdagenseizoen en brengt een golf van consumenten met zich mee die voor alle aanbiedingen komen. Hoe kan deze dag voor zowel consumenten […]

Thu, 28 Sep 2023 12:00:00 +0000

|

Is Vlaamse verfijning in zakelijke e-mail nodig?

Dat Nederlanders goed zijn in talen, is je misschien niet onbekend. Zo behoren we volgens onderzoek* bijvoorbeeld tot de top als het om beheersing van de Engelse taal gaat. Daarbij hebben we in verhouding ook redelijk veel kennis van buitenlandse talen. Maar: hoe zit dat precies met het Vlaams versus Nederlands? En hoe schrijf je […]

Thu, 28 Sep 2023 09:00:00 +0000

|

| |

World: SmallBusinessTrends: [ Geolocation ] (Laatste update: vrijdag 13 oktober 2023 18:06:37)

|

Experiential Marketing Small Business Strategies That Boost Sales

With experiential marketing, you can connect emotionally with your customers.

Fri, 13 Oct 2023 14:00:17 +0000

|

55 Free Marketing Tools For Any Small Business To Use

In this article, we'll reveal 55 invaluable tools that can make a difference for your business so it can be productive and grow.

Fri, 13 Oct 2023 13:00:44 +0000

|

Whaling Email Scams Target the Company Boss – That’s You!

The latest cyber scam affecting small businesses is targeting company bosses. Here's how to spot a whaling email and protect your company.

Fri, 13 Oct 2023 13:00:01 +0000

|

7 Ideas to Improve Brand Loyalty Through Email Marketing

If your business is not using email marketing to create brand loyalty, then you're missing an opportunity. Here are seven strategies to get you started.

Fri, 13 Oct 2023 12:30:47 +0000

|

Canva’s AI Image Generation is a Boon for Small Business Owners

Explore how Canva's AI image tools empower small businesses with tailored visuals, ensuring unique branding in a digital age across platforms.

Fri, 13 Oct 2023 12:30:18 +0000

|

Managing the Double-Edged Sword of Teaser Emails

Has your email marketing campaign fallen flat? It's all about the tease you're giving readers when they get your message in their inbox. A good tease warrants a click to your site. A poor tease prompts hitting the Trash button. Here's how to get recipients to open your message and follow it to your site.

Fri, 13 Oct 2023 10:30:17 +0000

|

Using These 10 Phrases in Your Email Marketing May Keep you from Success

Want to get your emails sent right to someone's Spam folder? Probably not. So, avoid these spam trigger words at all cost.

Fri, 13 Oct 2023 10:30:00 +0000

|

How to Start an IV Hydration Business

IV hydration therapy is growing in popularity. If you want to learn how to start an IV hydration business, this guide will get you going.

Fri, 13 Oct 2023 10:00:07 +0000

|

What is Cultural Competence and How Can It Transform Your Leadership?

Understanding others' cultures will help you be a better small business leader. Here are some ways to gain, and benefits from, cultural competency.

Fri, 13 Oct 2023 09:46:23 +0000

|

How to Use Email Marketing to Drive Social Engagement

Give some added purpose to your current email marketing campaign by striving to increase social media engagement on your numerous channels.

Fri, 13 Oct 2023 09:30:16 +0000

|

| |

World: Trendwatching.com: [ Geolocation ] (Laatste update: vrijdag 13 oktober 2023 02:35:19)

|

Lidl lowers prices of its vegan products to match animal-based equivalents

Spotted by: Liesbeth den Toom

Thu, 12 Oct 2023 06:30:37 GMT

|

IKEA introduces new anti-tip feature for dressers and shares it with competitors

Spotted by: Liesbeth den Toom

Wed, 11 Oct 2023 04:32:00 GMT

|

Montreal is adding 30 sponge parks and 400 sponge sidewalks to cope with torrential rain

Spotted by: Marie-Michele Larivee

Tue, 10 Oct 2023 12:58:17 GMT

|

Thebe Magugu's Family Heirloom Shirt memorializes anyone's loved one in African wax print

Mon, 09 Oct 2023 11:13:39 GMT

|

In Stockholm, Houdini opens the world's first circular outdoor apparel store

Spotted by: Caitlin Hughan

Fri, 06 Oct 2023 05:28:48 GMT

|

ROEF redefines green roofs with solar integration and one-day installation

Spotted by: Liesbeth den Toom

Thu, 05 Oct 2023 14:34:55 GMT

|

HAPPY Speeltijd's spinning wheel tags game for kids to play and ensures no one is left out

Spotted by: Liesbeth den Toom

Wed, 04 Oct 2023 09:38:07 GMT

|

Ulta Beauty trains sales associates to help them (and customers) ditch negative self-talk

Tue, 03 Oct 2023 05:16:00 GMT

|

Antwerp residents test noise-canceling fountains to mask traffic noise

Mon, 02 Oct 2023 12:44:33 GMT

|

New ad by energy supplier OVO is only served when the power grid is greenest

Related: Doconomy billboards bring real-time climate data to Stockholm's streets

Fri, 29 Sep 2023 05:51:45 GMT

|

| |

World: Yahoo Finance: [ Geolocation ] (Laatste update: vrijdag 13 oktober 2023 22:35:24)

|

This Key Contrarian Market Indicator Just Turned Bearish

As we close out another trading week, let's take a close look at the market dashboard. Two of the major equity indexes violated support and turning bearish in Thursday's trading action. Near-term trends remain a mix of neutral and bearish implications.

Fri, 13 Oct 2023 15:23:00 +0000

|

4 Moves To Consider If Your Retirement Fund Stops Growing — Even If You’ve Already Retired

Many U.S. retirement savings plans hit the skids in 2022 during one of the worst years for the stock market this century. The S&P 500 sank 19.44% in 2022, according to MacroTrends, while the...

Fri, 13 Oct 2023 15:18:24 +0000

|

| |

World: Zerohedge.com: [ Geolocation ] (Laatste update: vrijdag 6 oktober 2023 21:16:56)

|

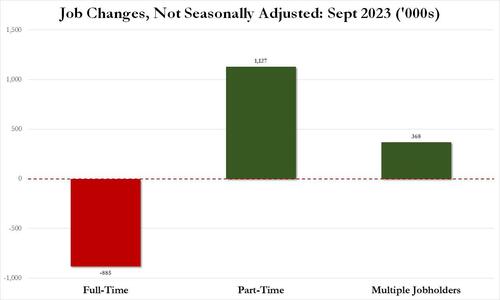

Inside Today's Jobs Report: 885,000 Full-Time Jobs Lost, 1.127 Million Part-Time Jobs Added, Record Multiple Jobholders

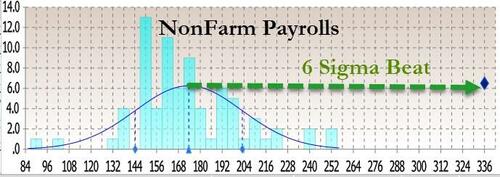

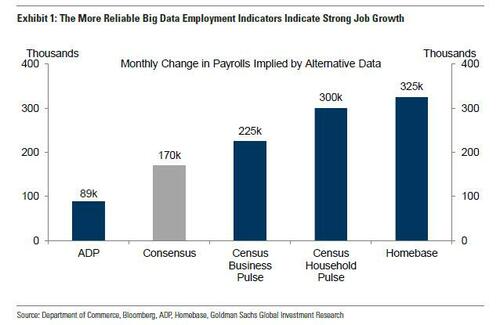

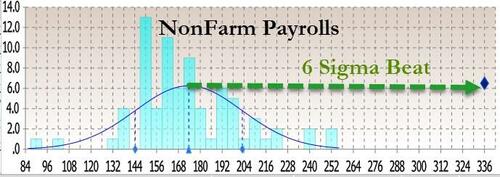

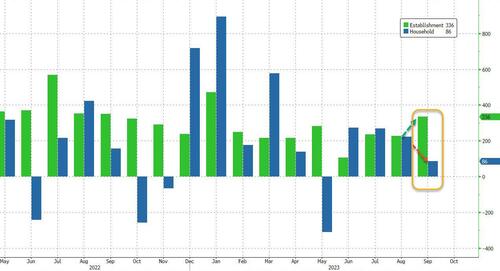

Inside Today's Jobs Report: 885,000 Full-Time Jobs Lost, 1.127 Million Part-Time Jobs Added, Record Multiple JobholdersAfter last month's stunning payrolls report, when in our post-mortem we revealed not only a year full of monthly downward data revisions, but also collapse in tull-time jobs and surge in part-time jobs, as well asalso the worst unadjusted August payrolls since the great recession, we thought that nothing could shock us any more. And then we got the September jobs report. We won't spend too much time dissecting the report since regular readers are all too aware of the same old "upward goalseeking" tactics used by the BLS, so here are the highlights. First, the 336K jump in headline payrolls - the biggest since January - was stunning when considering that it was not only above the highest Wall Street estimate but was a 6-sigma beat to expectations.

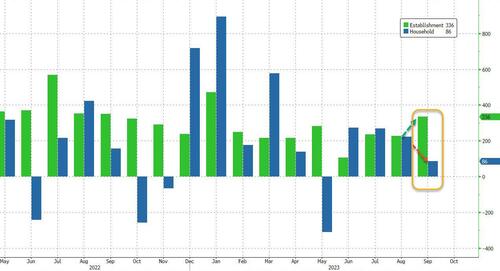

How is it possible to get such an outlier print to not only trends but expectations? Let's try to answer that question. If, as the BLS claims, in September the jobs market suddenly reversed a year of declines, surely there will be some qualitative validations to this quantitative outlier, right? Unfortunately, looking through the supporting evidence we don't find any justification to the BLS exuberance. Let's start with the Household survey: here instead of a number anywhere close to the 336K jobs gained (as the far less accurate Establishment survey reports), the number of newly employed workers was just 86K, the lowest since May, and the second lowest of 2023!

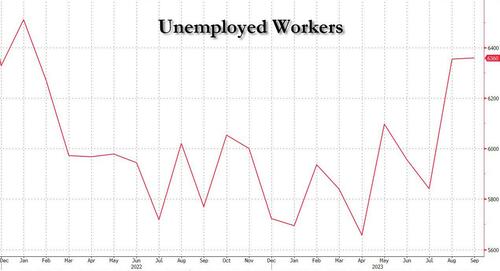

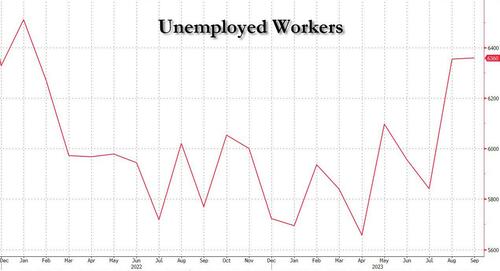

And since the number of unemployed workers also rose to 6.360 million, the highest number since January 2022, the unemployment rate was sticky at 3.8%, and refused to drop to 3.7% as consensus had expected.

How about the Establishment survey? Well, here too, things stink. Yes, the headline surge was great, but the question here is how much of that was purely seasonals. Consider what Vanda Research FX trader Viraj Patel noted earlier: the official adjusted data showed this Leisure and Hospitality added a whopping +96k jobs. But unadjusted data showed that the sector lost 466k jobs in Sep. This means that the unadjusted private sector payrolls was -399! Wait, if unadjusted total payrolls rose by 585K and yet private payrolls dropped by 399K, that means that... you got it: in September, all of the unadjusted jobs came from - drumroll - the government, which added a whopping 984K jobs(mostly teachers).

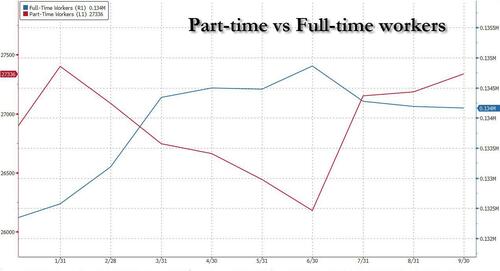

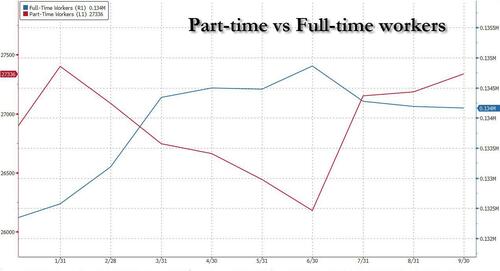

Translation: for yet another month all the strength in the Establishment was thanks to seasonals and various plugs that made the total number much stronger. And now, let's turn again to the much more detailed and accurate Household Survey, where we find the BLS back to its old tricks again. First, as we pointed out earlier, despite the alleged quantitative surge, the quality of the jobs was anything but good. In fact, looking at the infamous table A-9 of the employment report, reveals that in September, a seasonally adjusted breakdown of jobs shows that part-time workers accounted for the entire increase, rising by 151K; as for full-time workers? Well, for yet another month, this number dropped, sliding by 22K in September. Indeed, as shown in the chart below, while part-time workers rose for the third consecutive month to 27.336 million,and the highest since January, full-time workers have decline for three straight months, and at 134.167 million, this was the lowest number going back to February!

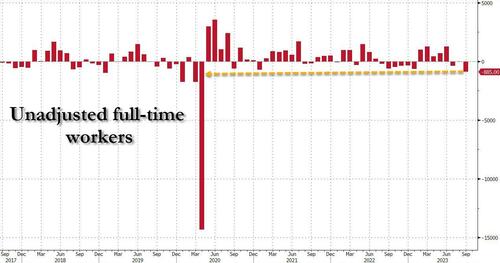

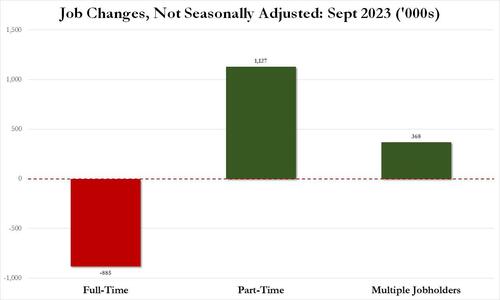

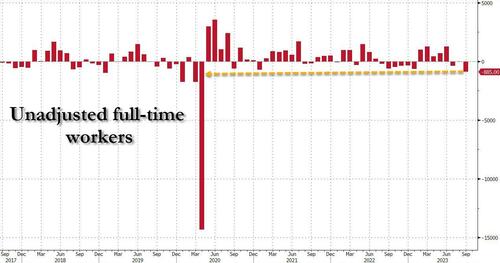

But hold on, you say, why use Seasonally Adjusted number when we already noted above that there continue to be chronic issues with the BLS' seasonal adjustments in the post-covid era. True, so let's use unadjusted numbers instead. What do we get? Well, we get the following whopper: in September, the number of unadjusted full-time workers collapsed by 885K. This was the biggest monthly drop since - drumroll- April 2020 when the economy was shut down!

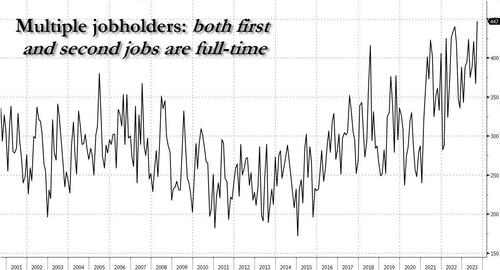

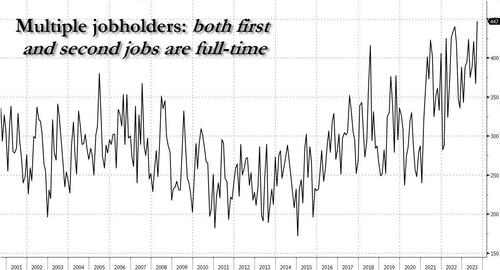

And if full-time workers plunged, that must mean that part-timers exploded, right? Why yes, they did: by 1.127 million in one month to be precise, and at 27.109 million the number of part-time workers was the highest since April. Finally, let's not forget the number of multiple jobholders: those unlucky souls which have to work not one but two (or more) jobs to make ends meet under Bidenomics. Also, multiple jobholders (which are measured by the Household Survey) are double, and triple- counted when it comes to the Establishment Survey. So how did thy do in September? Well, on a seasonally adjusted basis, the number increased by 123K to 8.151 million, the highest since January 2020. As for the much more accurate, unadjusted number, well that soared from 7.778 million to 8.146 million, an increase of 368K, or more than all the 336K payrolls reported by the establishment survey. In other words, all of the job gains in September were either from part-time workers or multiple jobholders forced to get another job in addition to their current one, and thus be counted by the BLS as two distinct jobs (or more). One final observation on the multiple jobholders: in September, the subset of multiple jobholders who held both a primary and secondary full-time job just hit an all time high.

Visually, this is what September's "stunning" jobs report really looked like.

Source for everything: BLS, but one needs to do some actual work to get a sense of what is really going on.

Fri, 06 Oct 2023 15:45:00 +0000

|

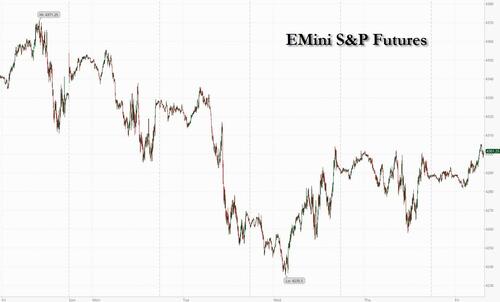

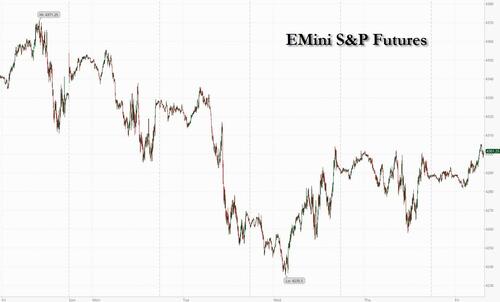

Futures, Yields Rise Ahead Of Jobs Report

Futures, Yields Rise Ahead Of Jobs ReportGlobal stocks and US index futures gained ahead of the September payrolls report (exp. payrolls 170K, unemp 3.7%, full preview here) that could potentially ease pressure on the Federal Reserve to raise interest rates again. At 7:45am ET, S&P futures rose 0.1%, after falling by a similar amount on Thursday while the tech-heavy Nasdaq 100 rose 0.2%, after slipping 0.4% the day before. Shares climbed in Asia and Europe, while mainland Chinese markets remain shut for a weeklong holiday. Treasury yields extended their advance, with the 10-year hovering around 4.74% after reaching 4.88% earlier this week. The Bloomberg dollar index was little changed. Oil was also little changed, halting its decline this week. All eyes on today’s NFP release at 8.30am, which is the near-term focus to set narrative: consensus expects NFP to print 170k and the unemployment rate to print 3.7%.

In premarket trading, shale giant Pioneer Natural rose as much as 10% after WSJ reported that Exxon Mobil is in talks to acquire the company. Exxon Mobil fell as much as 2.1%. Tesla fell as much as 1.6% as the electric-vehicle maker cut prices on its most popular cars in the US. Here are some other notable premarket movers: - Aehr Test Systems fell as much as 14% after the supplier of semiconductor test and production burn-in equipment reported its first-quarter results.

- AMC Entertainment Holdings Inc. gained 2.8% after it said it sold more than $100 million in advance tickets for the Taylor Swift/The Eras Tour Concert movie.

- Elf Beauty rose as much as 2.5% as Jefferies raised to buy from hold. The broker says it sees a buying opportunity following the recent valuation pullback in the cosmetics company. .

- Shoals Technologies Group rose as much as 4% as Piper Sandler raised to overweight from neutral. The broker said it’s upgrading the solar-energy equipment maker after the recent pullback in its shares. .

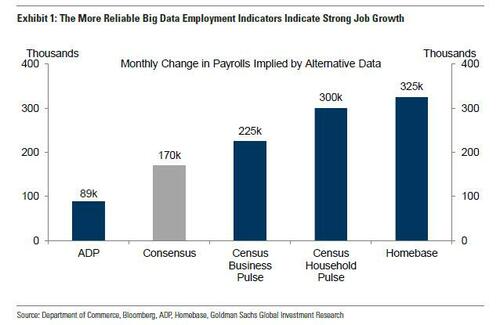

Today's nonfarm payrolls report is forecast to show employers slowed hiring last month, with 170,000 jobs being added last month, down from 187,000 in August. The crowdsourced whisper number is 190k, while Goldman warns that big data indicators hint at an even larger beat. In any event, this is expected to be the last to show solid hiring before a sharp slowdown.

Job data earlier this week provided a discordant narrative: job-openings overshot estimates, while a measure of private employment from ADP was weaker than forecast. Here is a forecast of payrolls by bank (with our full preview available here). - 240,000 - Citigroup

- 200,000 - Goldman Sachs

- 200,000 - UBS

- 190,000 - HSBC

- 190,000 - Societe Generale

- 180,000 - Morgan Stanley

- 175,000 - JP Morgan Chase

- 173,000 - Bloomberg Economics

- 150,000 - Deutsche Bank

- 150,000 - Wells Fargo

“Although both numbers haven’t been moving in tandem recently, the lower-than-expected ADP figures have given markets hope that September nonfarm payrolls will surprise to the downside,” said Julien Lafargue, chief market strategist at Barclays Private Bank. “Beyond the number of job creations, investors will pay close attention to wage growth figures and whether they confirm recent disinflationary trends.” Meanwhile, the global bond selloff is hammering risk assets from stocks to corporate credit on concerns that central banks will keep interest rates elevated longer than expected. While 30Y yields this week touched 5% for the first time since 2007 and subsequently dropped, on Friday Treasury yields once again extended their advance, with the 10-year adding two basis points to 4.74% after reaching 4.88% earlier this week. A gauge of dollar strength was little changed. The beaten-down bond sector will make a staggering comeback in 2024 when higher interest rates send the economy into a recession, according to BofA's Michael Hartnett. Once the recession being priced by bond and stock markets “mutates into economic data, bonds rally big and bonds should be the best performing asset class in the first half of 2024,” Hartnett wrote in a note. “Friday’s payrolls data, and next week’s inflation number, will decide whether the 10-year Treasury yield goes up to 5% or down to 4.5%,” said Kenneth Broux, a strategist at Societe Generale in London. A higher-than-forecast jobs number may trigger “another wave of dollar-buying and bond-selling,” he said. Traders have record sums riding on the outcome of November’s Fed meeting as investors and policymakers debate the likelihood of a further rate increase this year. San Francisco Fed President Mary Daly, who doesn’t vote on the Fed’s rate-setting committee this year, said the central bank may keep rates on hold if inflation and the jobs market cool. In Europe, the Stoxx 600 rose as much as 0.8%, extending earlier advance as bond yields remain in Thursday’s range and gains in dollar pause ahead of US job data. FTSE MIB outperforms peers. Insurance +2% and banks +1.6% lead gains; Food and beverages -1.5% and personal care -0.9% are the only sectors in the red. Insurers led gains in Europe’s Stoxx 600 index, after Aviva Plc was cited in a newspaper as a target for potential bidders. Prudential, Legal & General Group and Phoenix also rose. Here are the most notable European movers: - Shell shares rise as much as 1.5% after it says its earnings from gas trading rebounded in the third quarter from the dip seen in the prior period.

- Aviva shares rise as much as 8.3% to 420.40p after The Times reported market speculation that the insurer may be attracting interest from at least two potential bidders.

- Man Group gains as much as 4.6%, most since Mar. 21, after BNP Paribas Exane raised its recommendation on the UK-listed hedge fund to outperform from neutral.

- Maire shares gain as much as 7.5% as Mediobanca upgrades the technology and engineering group to outperform from neutral, after it won the largest order in the group’s history.

- Nestle shares drop as much as 3.4% to the lowest since March 2021, biggest laggard in Europe’s Stoxx 600 Index by index points. Retail giant Walmart said Wednesday that it’s already seeing an impact on shopping demand from people taking Ozempic, Wegovy and other appetite-suppressing medications.

- Philips shares fall as much as 8.5%, the most in a year, after the company said it agreed with the US FDA recommendations to implement additional testing on certain sleep and respiratory care devices to supplement current test data.

- JD Wetherspoon falls as much as 4.8%, the most in two months, as Morgan Stanley notes the UK pub chain now anticipates a “reasonable outcome” for the 2024 fiscal year, versus the “improved outcome” guidance provided at 4Q results. Wetherspoon said it returned to profit in the 12 months through July.

- CD Projekt shares widen two-day decline to 12% as analysts point to negative surprise concerning the cost of production of the Phantom Liberty paid add-on to its Cyberpunk 2077 game that may limit profits from the new release.

Earlier in the session, Asia stocks also gained, led by a rally in Hong Kong shares, while other markets were more muted with all eyes on the US payroll data for cues on the Federal Reserve’s policy path. The MSCI Asia Pacific Index rose as much as 0.7% Friday, paring its slide for the week to 1.4%. It would be the third consecutive week of declines for Asian stocks. Chinese tech giants Tencent, Alibaba and Meituan were among the biggest contributors to the gauge’s advance. The benchmark tumbled into a technical correction earlier this week amid concern over higher-for-longer US rates. Hong Kong stocks were the biggest gainers in the region, with analysts citing positive Golden Week holiday spending data and positioning ahead of the reopening of mainland markets as drivers. Japan equities were mixed while benchmarks in Australia and South Korea edged higher. - Hang Seng outperformed amid strength in tech, property and banking stocks, with sentiment also underpinned by hopes of a stabilisation in US-China ties as the White House is reportedly planning a Biden-Xi meeting in California next month although nothing has been confirmed yet.

- Japan's Nikkei 225 was choppy as better-than-expected Household Spending data was offset by slower wage growth, while former BoJ official Momma said the BoJ will likely discuss whether to tweak forward guidance along with YCC at the end-October meeting.

- Australia's ASX 200 was led by gains in the top-weighted financial sector after the latest RBA Financial Stability Review which noted increasing global financial stability risks but also stated that Australian banks are well-capitalised and well-positioned to manage any increase in mortgage arrears and absorb loan losses.

- Indian stocks gain for a second day, supported by a pause on interest rates by the central bank and gains in the technology and capital goods companies. The S&P BSE Sensex rose 0.6% to 65,995.63 in Mumbai on Friday, while the NSE Nifty 50 Index advanced by the same measure. The MSCI Asia Pacific Index was up 0.5%.

In FX, the Bloomberg dollar spot index erased an earlier advance. GBP and CAD are the strongest performers in G-10 FX, JPY and AUD underperform. - The EUR/USD pared a 0.2% drop to trade little changed at 1.0552. The pair is down a 12th week, the longest streak of losses since 1997.

- GBP/USD rose 0.1% to 1.2203, heading for a third daily advance for the first time since August

- The yen led declines among Group-of-10 currency peers. USD/JPY extended gains, rising as much as 0.3% to 148.99 after Japan’s slower-than-expected wage growth suggests the Bank of Japan has to wait more to normalize policy

In rates, treasuries were slightly cheaper across the curve ahead of September jobs report, with futures trading just off Thursday session highs, as stock futures hold small gains. Gilts underperformed in early London session, adding to upside pressure on Treasury yields, while WTI oil futures are little changed after past week’s collapse. US yields 2bp-3bp cheaper with curve spreads little changed on the day; 10-year TSYs were around 4.74%, around the middle of Thursday’s range, with gilts lagging by 1.5bp in the sector. Gilt 10-years slightly underperform comparable bunds and USTs. A survey by BMO Capital Markets on client attitudes toward rates market found the lowest willingness to buy in a year � 37% vs a 49% average � if bond prices fall after the jobs report. The Dollar IG issuance slate empty so far and expected to be muted Friday ahead of Monday’s bank-and-bond-market holiday; three names priced $2.5b Thursday, taking weekly volume to almost $9b, below the $15b projected In commodities, oil trades slightly higher on the day, but is poised for the biggest weekly drop since March. Spot gold is little changed at $1,820/oz. Looking at the day ahead, today's US economic data slate includes September jobs report (8:30am) and August consumer credit (3pm). Scheduled Fed speakers include Waller at 12pm Market Snapshot - S&P 500 futures little changed at 4,290.50

- MXAP up 0.4% to 154.81

- MXAPJ up 0.8% to 486.12

- Nikkei down 0.3% to 30,994.67

- Topix little changed at 2,264.08

- Hang Seng Index up 1.6% to 17,485.98

- Shanghai Composite up 0.1% to 3,110.48

- Sensex up 0.6% to 66,024.33

- Australia S&P/ASX 200 up 0.4% to 6,954.17

- Kospi up 0.2% to 2,408.73

- STOXX Europe 600 up 0.4% to 442.89

- German 10Y yield little changed at 2.90%

- Euro little changed at $1.0543

- Brent Futures up 0.4% to $84.41/bbl

- Gold spot down 0.0% to $1,819.92

- U.S. Dollar Index little changed at 106.42

Top Overnight News - The White House has begun making plans for a November meeting in San Francisco between President Biden and Chinese leader Xi Jinping � an attempt to stabilize the relationship between the world’s two most powerful countries, according to senior administration officials. WaPo

- India’s RBI keeps rates unchanged, as expected, but suggested it would hold policy tight going forward due to ongoing inflation concerns. WSJ

- Beijing’s tough treatment of foreign companies this year, and its use of exit bans targeting bankers and executives, has intensified concerns about business travel to mainland China. Some companies are canceling or postponing trips. Others are maintaining travel plans but adding new safeguards, including telling staff they can enter the country in groups but not alone. WSJ

- Russia allowed a return to seaborne exports of diesel just weeks after imposing a ban that roiled global markets, taking other steps instead to keep sufficient fuel supplies at home. BBG

- European gas jumped as union members at Chevron LNG facilities in Australia voted to resume industrial action after criticizing the company's efforts to finalize a deal on pay and conditions. BBG

- The ECB may need to raise interest rates again if wages, profits or new supply snags boost inflation, ECB board member Isabel Schnabel said in an interview published on Friday. RTRS

- Tesla cut prices on its Model 3 and Y cars in the US again, days after its third-quarter deliveries missed. BBG

- The corporate borrowing binge over the past 18 months shows C-suites across the US have been largely undeterred by the Fed's relentless hikes. Not only have they displayed little desire to pay down debt, but many have heaped more of it on their books. The recent yield spike may have cooled the market, but the overall pace of borrowing has been blistering. BBG

- Exxon is in talks to acquire Pioneer Natural Resources, a person familiar said. An agreement worth as much as $60 billion may completed within days, the WSJ reported, making it the world's largest deal this year and Exxon's biggest acquisition in over two decades. WSJ

- We estimate nonfarm payrolls rose by 200k in September (mom sa), above consensus of +170k. We estimate that the unemployment rate declined one tenth to 3.7%� in line with consensus� reflecting a rise in household employment and unchanged labor force participation at 62.8% (we do not expect the August rise in the foreign-born labor force to reverse). We estimate a 0.30% increase in average hourly earnings (mom sa) that edges the year-on-year rate lower by 1bp to 4.28%, reflecting waning wage pressures but positive calendar effects (the latter worth +5bps month-over-month, on our estimates). Consensus for average hourly earnings is +0.3% mom and +4.3% yoy. GIR

A more detailed look at global markets courtesy of Newsquawk APAC stocks traded mostly higher albeit with some of the upside capped following the inconclusive performance on Wall St and as participants await the incoming US Non-Farm Payrolls report. ASX 200 was led by gains in the top-weighted financial sector after the latest RBA Financial Stability Review which noted increasing global financial stability risks but also stated that Australian banks are well-capitalised and well-positioned to manage any increase in mortgage arrears and absorb loan losses. Nikkei 225 was choppy as better-than-expected Household Spending data was offset by slower wage growth, while former BoJ official Momma said the BoJ will likely discuss whether to tweak forward guidance along with YCC at the end-October meeting. Hang Seng outperformed amid strength in tech, property and banking stocks, with sentiment also underpinned by hopes of a stabilisation in US-China ties as the White House is reportedly planning a Biden-Xi meeting in California next month although nothing has been confirmed yet. Top Asian News - TSMC (2330 TT/TSM) September sales: (TWD) 180.43bln (prev. 188.69bln in Aug; -13% Y/Y), according to Reuters.

- A 6.1 magnitude earthquake has struck southeast of Honshu, Japan, according to GFZ.

European bourses trade on the front foot as indices attempt to recoup lost ground with the Stoxx 600 on track to close the week out with losses of over 1.5%. Sectors in Europe are mostly firmer with the current outperformers being Insurance, Banks, and Tech, while Food Beverages and Tobacco, Optimised Personal Care Drugs and Grocery, and Utilities reside as the laggards. US futures are trading marginally firmer, with overall sentiment tentative ahead of the big NFP report, expected to be released at 13:30 BST / 08:30 ET. Top European News - German Government expects GDP to decline by 0.4% in 2023 in draft Autumn projections, according to Reuters citing sources. German government foresees GDP growth of 1.3% in 2024 and 1.5% in 2025 and expects inflation of 6.1% in 2023 and 2.6% in 2024. Reasons for the expected mild GDP contraction in 2023 are high energy prices, high inflation and weakness in international trade, via Reuters citing German Government Source

FX - DXY is caged to a tight 106.34-55 with FX markets generally steady in the run-up to the US jobs report.

- Pound perked up enough in early trade to probe 1.2200 and decent expiry interest at the round number.

- EUR/USD secured a firmer grasp of the 1.0500 handle having closed bullishly above the 10 DMA yesterday.

- Kiwi and Aussie are underpinned by a pick-up in broad risk appetite rather than specifics.

Fixed Income - Bond futures have plateaued and pushed the bounds of recovery far enough ahead of the US jobs data - which has the potential to move the dial or even alter the overall trend.

- Bunds are close to 128.00 within their 128.17-127.79 intraday range having peaked on Monday at 128.50 and troughed at 126.62 on Wednesday.

- Gilts are midway between 92.86-53 stalls flanked by 93.71-91.50 w-t-d extremes.

- T-note is sitting tight inside 107-10/02 confines compared to a high of 107-29+ and 106-03+ low.

- Orders for Italy's new 5-yr BTP Valore retail bond touched EUR 16bln since the beginning of the offer, according to Reuters.

Commodities - Crude futures are choppy with two-way price action seen this morning as the complex consolidates after essentially wiping out its September gains at the start of this month.

- Dutch TTF futures are firmer intraday as the Offshore Alliance members at Chevron voted to recommence protected industrial action.

- Spot gold is flat within recent ranges while base metals rebounded off worst levels at the start of European trading but gains are capped ahead of the tier 1 US data in the afternoon.

- Offshore Alliance members at Chevron (CVX) vote to recommence protected industrial action, according to the union.

- Russia lifts diesel export ban via pipelines, according to Ifax.

Central banks - ECB's Schnabel said if risks materialise then further rate hikes may be necessary at some point, according to Reuters.

- ECB's Herodotou said monetary policy transmission is taking place to tame inflation, but energy prices and bank liquidity needs monitoring, according to Reuters.

- Former BoJ official Momma commented that the BoJ will likely discuss whether to tweak forward guidance along with YCC at the October 30th-31st meeting,

- RBA Financial Stability Review stated global financial stability risks are elevated and growing, while the risks include China's property sector, a disorderly fall in global asset prices and exposure to commercial real estate. The FSR also noted that tightening global financial conditions could slow growth and lift unemployment, while a fall in global asset prices could raise funding costs in Australia and limit the supply of credit. Nonetheless, it stated the Australian financial system is sound but there are some pockets of stress among household borrowers and Australian banks are well-capitalised with low exposure to commercial property, as well as well-positioned to manage any increase in mortgage arrears and absorb loan losses.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected, while it maintained the stance of remaining focused on the withdrawal of accommodation in which 5 out of 6 members voted in favour of the policy stance. RBI Governor Das said they have identified inflation as a major risk to macroeconomic stability and remain focused on aligning inflation to the 4% target with the MPC highly alert and will take timely measures as necessary. However, Das commented that headline inflation is to see further easing in September and the silver lining is the declining core inflation, as well as noted that the transmission of past rate hikes is thus far incomplete.

- RBI Governor Das said OMO sales are not for yield curve management but for liquidity management. Das added the RBI does not have a specific level in mind for the exchange rate; intervention is to prevent volatility in the FX market, according to Reuters.

- CNB Minutes: A large part of the debate was devoted to starting the process of lowering monetary policy rates and pace; the weakening of the FX rate over the past month had delivered a monetary policy easing of roughly 25-50bps, according to Reuters.

US Event Calendar - 08:30: Sept. Change in Nonfarm Payrolls, est. 170,000, prior 187,000

- Change in Private Payrolls, est. 160,000, prior 179,000

- Change in Manufact. Payrolls, est. 5,000, prior 16,000

- Unemployment Rate, est. 3.7%, prior 3.8%

- Underemployment Rate, prior 7.1%

- Labor Force Participation Rate, est. 62.8%, prior 62.8%

- Average Weekly Hours All Emplo, est. 34.4, prior 34.4

- Average Hourly Earnings YoY, est. 4.3%, prior 4.3%

- Average Hourly Earnings MoM, est. 0.3%, prior 0.2%

- 15:00: Aug. Consumer Credit, est. $11.7b, prior $10.4b

DB's Jim Reid concludes the overnight wrap Risk assets were under pressure again over the last 24 hours, with investors remaining cautious before today’s US jobs report. For instance, oil prices remained on track for their worst weekly performance since the banking turmoil in March, having now shed more than -11% this week. Credit spreads widened as well, with US HY spreads at their widest in more than 3 months. And whilst it’s true that sovereign bonds did recover some ground for the most part, we did see some new milestones for yields, and the US 30yr real yield (+6.8bps) closed at a post-2008 high of 2.50%. Furthermore, the spread between Italian and German 10yr yields closed above 200bps for the first time since early February. US equities also lost further ground, with the S&P 500 down -0.13% in spite of a late recovery, and there’s been little respite this morning with futures for the index down -0.05%. With that backdrop in mind, the main highlight today is likely to be the US jobs report for September, which is the last before the Fed’s next decision on November 1. And since pricing for another rate hike this year has kept oscillating above and below 50% (currently 38% this morning), today’s reading will be important in determining if another hike remains on the table. The reading also follows a progressive slowing in job growth over recent months, and in the last report we saw the 3m average for payrolls growth fall to a post-pandemic low of +150k. Then on Wednesday this week, the ADP’s report of private payrolls showed the weakest monthly gain (+89k) since January 2021, which prompted investors to dial back the chances of another rate hike. But on the other hand, the weekly jobless claims yesterday were at 207k (vs. 210k expected) over the week ending September 30, which pushed the 4-week average down to its lowest since early February, at 208.75k. So there are signals pointing in both directions. For today, our US economists are expecting nonfarm payrolls to grow by +165k, which would see the unemployment rate tick down a tenth to 3.7%. With all that to look forward to, sentiment remained pretty negative in markets and there was a clear risk-off tone for much of the day yesterday. That was very clear in commodity markets, where oil prices continued to slump and Brent Crude fell another -2.03% to $84.07/bbl. Bear in mind that it was at $95/bbl at the start of the week, so with a -11.75% decline over four days, Brent is on track to almost match its worst week of the year back in March (-11.85%). If it’s sustained, this downward pressure could actually be very supportive for central banks as they seek to get inflation back to target. However, the reason it’s slumped is very much based on fears that growth is weakening, which in turn would reduce oil demand. It was a similar story for other cyclical commodities, and copper prices (often taken to be an industrial bellwether) were down -1.03% to a 4-month low. Meanwhile, the rise in real rates meant that gold (-0.06%) remained under pressure, with a 9th consecutive daily fall for the first time since 2016. When it came to equities, the risk-off mood dominated in the first half of the US session, with the S&P 500 down -0.89% at the lows of the day. But it recovered to end the day with a modest decline of -0.13%. Other US indices, including the NASDAQ (-0.12%), the FANG+ index (-0.14%) and the Russell 2000 (+0.14%), posted similar moves. Over in Europe, the STOXX 600 (+0.28%) ticked up from its 6-month low the previous day, but there still wasn’t much strength across the major indices, and the DAX (-0.20%) closed at a 6-month low. For sovereign bonds however, the risk-off tone meant they put in a much better performance, not least because investors moved to lower the chances of further monetary tightening. In the US, that meant yields on 10yr Treasuries were down -1.4bps to 4.72%, whilst in Europe there were also declines for yields on 10yr bunds (-4.0bps), OATs (-2.4bps) and gilts (-3.8bps). However, it wasn’t all good news, and longer-dated US Treasuries continued to struggle, with new records set among some real yields. For instance, the 20yr real yield (+6.4bps) hit a post-2009 high of 2.58%, and the 30yr real yield (+6.7bps) hit a post-2008 high of 2.49%. Italian BTPs also lost further ground, and the spread between 10yr BTP yields over bunds closed above 200bps for the first time since early February. That rates moves came amidst slightly less hawkish comments from Fed and ECB speakers. San Francisco Fed President Daly noted that the rise in yields in September “is equivalent to about a rate hike” and that the Fed can hold rates steady if the cooling of the labour market and inflation continues. Meanwhile, Richmond Fed President Barkin said that “we have time to see if we’ve done enough or whether there’s more work to do”. Over in Europe, Banque de France Governor Villeroy said that as of today he saw “no justification for an additional increase in the ECB rates”. Speaking of central banks, my colleague Peter Sidorov has published a report overnight on global central bank QT. We’ve seen DM central banks’ rundown of bond holdings accelerate in recent months and he observes that this QT pace is yet to peak. See the report here for more on QT trends and their implications. Overnight in Asia, there’ve been more positive signs in markets, with gains across the major equity indices. The Hang Seng (+1.81%) is leading the way, but there’s also been advances for the KOSPI (+0.26%) and the Nikkei (+0.08%), whilst markets in mainland China remain closed for a holiday. The 10yr Treasury has also seen modest gains overnight, with yields down -0.6bps to 4.71%. To the day ahead now, and the main highlight will be the US jobs report for September. Other data includes German factory orders and Italian retail sales for August, along with the Canadian employment report for September. From central banks, we’ll hear from the Fed’s Waller, and the ECB’s Knot, Vasle, Vujcic and Kazimir.

Fri, 06 Oct 2023 11:54:40 +0000

|

Google Nieuws over Trends:

"Trends" - Google News

Google News

- 5 Trends Barcelona-Based Fashion People Are Into - Who What Wear

5 Trends Barcelona-Based Fashion People Are Into Who What Wear

- Coachella 2024 Design Trends - BizBash

Coachella 2024 Design Trends BizBash

- Joe's Blog: Concerning severe weather trends (THU-4/25) | FOX 4 Kansas City WDAF-TV | News, Weather, Sports - WDAF FOX4 Kansas City

Joe's Blog: Concerning severe weather trends (THU-4/25) | FOX 4 Kansas City WDAF-TV | News, Weather, Sports WDAF FOX4 Kansas City

- 5 AI trends to watch for the 2024 TV upfront - Ad Age

5 AI trends to watch for the 2024 TV upfront Ad Age

- Zacks Earnings Trends Highlights: Exxon and Chevron - Yahoo Finance

Zacks Earnings Trends Highlights: Exxon and Chevron Yahoo Finance

- MLB trends: Braves' aggression, Mariners' failed offseason gambit and Rockies' stunning futility record - CBS Sports

MLB trends: Braves' aggression, Mariners' failed offseason gambit and Rockies' stunning futility record CBS Sports

- Dream Destinations and Talent Mobility Trends | BCG - BCG

Dream Destinations and Talent Mobility Trends | BCG BCG

- The latest home trends and what to shop for your space - Good Morning America

The latest home trends and what to shop for your space Good Morning America

- Braves vs. Guardians odds, tips and betting trends - USA TODAY Sportsbook Wire

Braves vs. Guardians odds, tips and betting trends USA TODAY Sportsbook Wire

- The Top 5 Digital Media Marketing Trends in 2024 for Gen Z and Millennials Show a Streaming ‘Crisis,’ the Power of Fandom and Much More - Variety

The Top 5 Digital Media Marketing Trends in 2024 for Gen Z and Millennials Show a Streaming ‘Crisis,’ the Power of Fandom and Much More Variety

- Hyte made me fall in love with my gaming PC all over again - Digital Trends

Hyte made me fall in love with my gaming PC all over again Digital Trends

- Only 2% of TikTok Diet Trends Are Accurate: 5 Things to Know - Healthline

Only 2% of TikTok Diet Trends Are Accurate: 5 Things to Know Healthline

- 5 Attack Trends Organizations of All Sizes Should Be Monitoring - Dark Reading

5 Attack Trends Organizations of All Sizes Should Be Monitoring Dark Reading

- Video: FOX23 looks at tornado trends | Watch Now | fox23.com - KOKI FOX 23 TULSA

Video: FOX23 looks at tornado trends | Watch Now | fox23.com KOKI FOX 23 TULSA

- DHS' Chris Kraft on emerging trends in AI and automation - FedScoop

DHS' Chris Kraft on emerging trends in AI and automation FedScoop

- Trends in World Military Expenditure, 2023 - SIPRI

Trends in World Military Expenditure, 2023 SIPRI

- Keep Up with Kitchen Trends - PR Newswire

Keep Up with Kitchen Trends PR Newswire

- Studies lacking for trans breast cancer screening trends - AuntMinnie

Studies lacking for trans breast cancer screening trends AuntMinnie

- New Infrastructure—Emerging Trends in Chinese Investment in Latin America - The Dialogue - Inter-American Dialogue

New Infrastructure—Emerging Trends in Chinese Investment in Latin America - The Dialogue Inter-American Dialogue

- Trends Expert Encourages 'Aha Moments' for Bellevue Tourism Industry - 425business.com

Trends Expert Encourages 'Aha Moments' for Bellevue Tourism Industry 425business.com

- We Are Social's April Statshot Reveals Global Social Media Trends | LBBOnline - Little Black Book - LBBonline

We Are Social's April Statshot Reveals Global Social Media Trends | LBBOnline Little Black Book - LBBonline

- Should ads follow trends and tropes, or is it simply lazy creative? - The Drum

Should ads follow trends and tropes, or is it simply lazy creative? The Drum

- Milan Show Sets Records, Highlights Trends - Kitchen and Bath Design News

Milan Show Sets Records, Highlights Trends Kitchen and Bath Design News

- White House's Conrad Stosz talks emerging AI trends - FedScoop

White House's Conrad Stosz talks emerging AI trends FedScoop

Flickr Public Images: Trends

Flickr Photo's tagged Trends

Rachel McDonnell - MISS V♛ PORTUGAL 2017 posted a photo:

★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★

• Posted by Rachel McDonnell:

★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★

▪ Follow me on Social Media:

About me • Facebook • Flickr

★ ★ ★ ★ ★ ★ I would like to thank you in advance for all views, favorites and comments,I´m sorry if I don´t have time to thank to everyone ★ ★ ★ ★ ★ ★

★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★

❇ Credits:

★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★

❇ -AZUL- Liezel [FF2024]

📌 FANTASY FAIRE

❇ Zibska Miriam Headpiece

📌ZIBSKA

❇ JUMO Originals - HILLARY Earrings

📌 JUMO

❇ PLACE--📌 Elven Forest

-----------------------------------------------------------------------------------

📌 LELUTKA Avalon Head

📌 LEGACY- PERKY Meshbody (f)

Published: 2024-04-25 - 00:02:06

PRECIOSA ORNELA posted a photo:

The trending colors for Spring/Summer 2025

LAMPWORKING RODS FROM THE PRECIOSA TRADITIONAL CZECH GLASS™ BRAND

Be inspired when creating the colors that will dominate the 2025 Spring/Summer season. Choose contemporary glass combinations in trending colors from the wide range of lampworking or composite rods from the PRECIOSA Traditional Czech Glass™ brand for your work.

SPRING AWAKENING

Subdued shades supplemented with a contrasting blue will evoke nature in the 2025 Spring-Summer season. Your creations should include the forget-me-not, heavenly, cloudy, smoky, brick or mahogany shades.

SPRING-SUMMER INTENSITY

The 2025 Spring/Summer season will be dominated by distinctive colors. This should definitely include the plum, grass green, lagoon, sandy or orange shades.

SUMMER DELICACY

The delicate pastels of lampworking beads in shades of banana, peach, rose-orange flower or lychee supplemented with forget-me-not symbolise the arrival of warm summer days.

SUMMER PLAFULNESS

Add playfulness to your designs with the opaque pastel colors from the 2025 Spring/Summer trend forecast. Be sure to use azure, violet, spring, melon or opaque rose.

Visit our website for more information about the trends

WEBSITE | FACEBOOK | YOUTUBE | PINTEREST |

INSTAGRAM

Published: 2024-04-24 - 11:56:15

PRECIOSA ORNELA posted a photo:

The trending colors for Spring/Summer 2025

LAMPWORKING RODS FROM THE PRECIOSA TRADITIONAL CZECH GLASS™ BRAND

Be inspired when creating the colors that will dominate the 2025 Spring/Summer season. Choose contemporary glass combinations in trending colors from the wide range of lampworking or composite rods from the PRECIOSA Traditional Czech Glass™ brand for your work.

SPRING AWAKENING

Subdued shades supplemented with a contrasting blue will evoke nature in the 2025 Spring-Summer season. Your creations should include the forget-me-not, heavenly, cloudy, smoky, brick or mahogany shades.

SPRING-SUMMER INTENSITY

The 2025 Spring/Summer season will be dominated by distinctive colors. This should definitely include the plum, grass green, lagoon, sandy or orange shades.

SUMMER DELICACY

The delicate pastels of lampworking beads in shades of banana, peach, rose-orange flower or lychee supplemented with forget-me-not symbolise the arrival of warm summer days.

SUMMER PLAFULNESS

Add playfulness to your designs with the opaque pastel colors from the 2025 Spring/Summer trend forecast. Be sure to use azure, violet, spring, melon or opaque rose.

Visit our website for more information about the trends

WEBSITE | FACEBOOK | YOUTUBE | PINTEREST |

INSTAGRAM

Published: 2024-04-24 - 11:56:19

PRECIOSA ORNELA posted a photo:

The trending colors for Spring/Summer 2025

LAMPWORKING RODS FROM THE PRECIOSA TRADITIONAL CZECH GLASS™ BRAND

Be inspired when creating the colors that will dominate the 2025 Spring/Summer season. Choose contemporary glass combinations in trending colors from the wide range of lampworking or composite rods from the PRECIOSA Traditional Czech Glass™ brand for your work.

SPRING AWAKENING

Subdued shades supplemented with a contrasting blue will evoke nature in the 2025 Spring-Summer season. Your creations should include the forget-me-not, heavenly, cloudy, smoky, brick or mahogany shades.

SPRING-SUMMER INTENSITY

The 2025 Spring/Summer season will be dominated by distinctive colors. This should definitely include the plum, grass green, lagoon, sandy or orange shades.

SUMMER DELICACY